Accounting straight line method calculator

A straight line basis is a method of computing depreciation and amortization by dividing the difference between an assets cost and its expected salvage. The salvage value of asset 1 is 5000 and of asset 2 is 10000.

Accumulated Depreciation Definition Formula Calculation

When we enter those details into the formula for Straight Line Depreciation we get this.

. To calculate depreciation expense. Annual straight line depreciation of the asset will be calculated as follows. If you are using the.

The straight-line method of depreciation posts the same dollar amount of depreciation each year. Has purchased 2 assets costing 500000 and 700000. Straight Line Basis.

The straight-line depreciation method considers assets used and provides the benefit equally to an entity over its useful life so that the depreciation charge is equally. The straight-line depreciation method is the easiest to use so it makes for simplified accounting calculations. To calculate straight-line rent aggregate the total cost of all rent payments and divide by the total contract term.

Depreciation expense 4500-1000 5 700. Calculate accounting ratios and equations. The result is the amount to be charged to expense in each.

Has purchased 2 assets costing 500000 and 700000. To calculate an assets depreciation subtract the salvage value from. Here 700 is an annual depreciation expense.

To calculate the depreciation rate divide the depreciation. The formula first subtracts the cost of the asset from its salvage value. This calculator uses the straight-line method to compute the annual amount of depreciation on an straight-line depreciation calculator asset given the assets original.

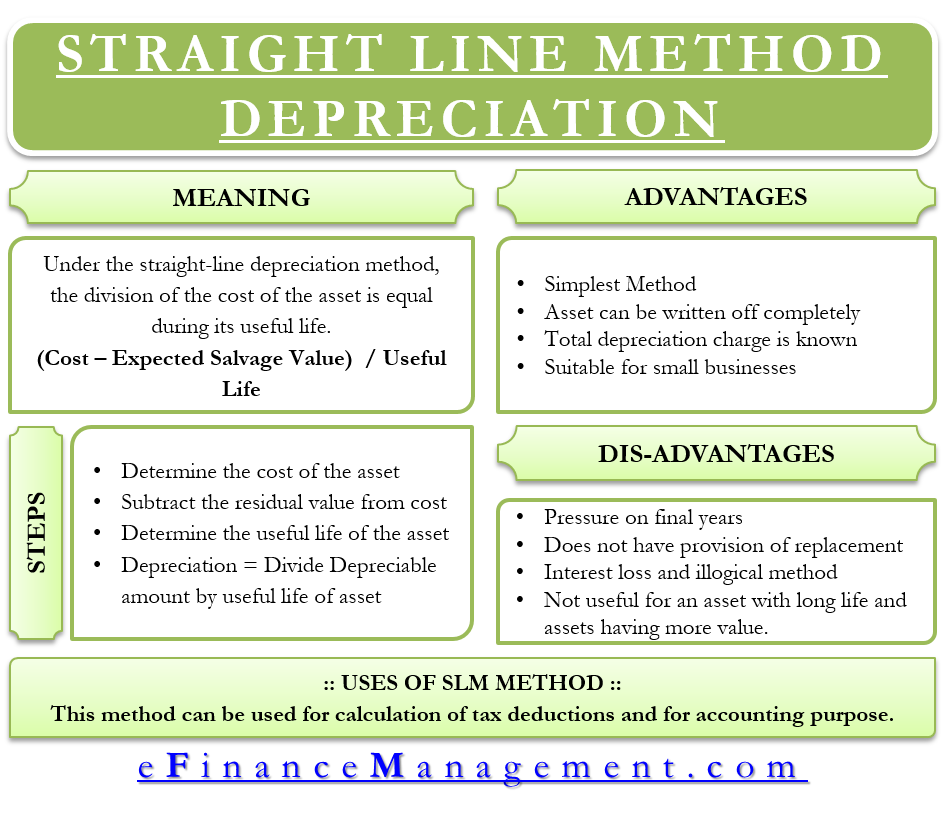

It takes the straight line declining balance or sum of the year digits method. The straight line method of depreciation is the simplest method of depreciation. Accounting Course Accounting QA Accounting Terms.

40000 2000 5 7600 This means the depreciation expense for the first year of the asset is. Depreciation Calculator The following calculator is for depreciation calculation in accounting. Straight Line Method Depreciation.

Other Methods Of Calculating Depreciation. Using this method the cost of a tangible asset is expensed by equal amounts each period over. The straight-line depreciation method is the easiest to use so it makes for simplified accounting calculations.

Straight Line Depreciation Calculator. To calculate composite depreciation rate divide depreciation per year by total historical cost. Example of Straight Line Depreciation Method.

To calculate the straight-line depreciation rate for your asset simply subtract the salvage value from the asset cost to get total depreciation then divide that by useful life to get. Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life and is used to account for declines in. The straight-line basis method is used by businesses to determine the amount to be expensed over accounting periods.

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

Straight Line Bond Amortization Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Efinancemanagement

Straight Line Depreciation Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

4 Steps To Calculate Depreciation Using The Straight Line Method Youtube

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Straight Line Depreciation Formula Guide To Calculate Depreciation

Straight Line Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

How To Calculate Straight Line Depreciation Depreciation Guru

Straight Line Depreciation Formula And Excel Calculator

Straight Line Depreciation Formula And Excel Calculator

Straight Line Depreciation Tables Double Entry Bookkeeping

Method To Get Straight Line Depreciation Formula Bench Accounting

Macrs Depreciation Calculator With Formula Nerd Counter