27+ indiana mortgage exemption

Comparisons Trusted by 55000000. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Executive Portfolio Vol 10 Iss 8 By Blue Heron Publications Llc Issuu

If the balance is.

. Mortgage balance must be over 3000 to get a full deduction. Web How does the Indiana homestead exemption work. Application for Property Tax Exemption.

Web Indiana Mortgage Deduction to End January 1 2023 Apr 19 2022 Beginning January 1 2023 Indiana home and property owners will no longer be able to. Web Where do I apply for mortgage and homestead exemptions. Main Street Crown Point IN 46307 219 755-3000 RESOURCES.

A homeowner or an individual must meet certain qualifications found. Ad 5 Best Home Loan Lenders Compared Reviewed. Web Property tax deductions must be filled out and filed in-person at the Porter County Auditors office in the Porter County Administration building located at 155 Indiana St Valparaiso.

Crown Point IN 46307. Lowest Rates Easy Online Process. Web 09284 Form 136.

The standard homestead deduction is either 60 of your propertys assessed value or a maximum of. To start your application for those deductions click here. Web Property owners must maintain a balance of 3000 or more at all times on their recorded mortgage or line of credit if your principle loan is paid in full to be eligible.

830 am - 430 pm. 27-1-12-14 to cover life insurance spouse. Select Popular Legal Forms Packages of Any Category.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. All Major Categories Covered. Web 2293 North Main Street.

Web You must be a resident of the State of Indiana and only one mortgage deduction is allowed. Web The deduction equals 3000 one-half of the assessed value of the property or the balance of the mortgage or contract indebtedness as of the assessment date which ever. Ad Weve Researched Lenders To Help You Find The Best One For You.

Notice of Action on Exemption Application. Follow the link below to the deduction. Web Hendricks County currently allows for the Homestead and Mortgage deductions to be applied for online.

For single debtors filing it has no coverage limit. Best Mortgage Lenders in Indiana. 27-1-12-14 Most people use Ind.

Web County Code of Ordinances - Updated 7-1-21 PROPERTY TAX DEDUCTIONS Various deductions are available to property owners.

North Stonington Ct Real Estate Homes For Sale Redfin

Business Innovators Radio Podcast Addict

Indiana Bankruptcy Exemptions

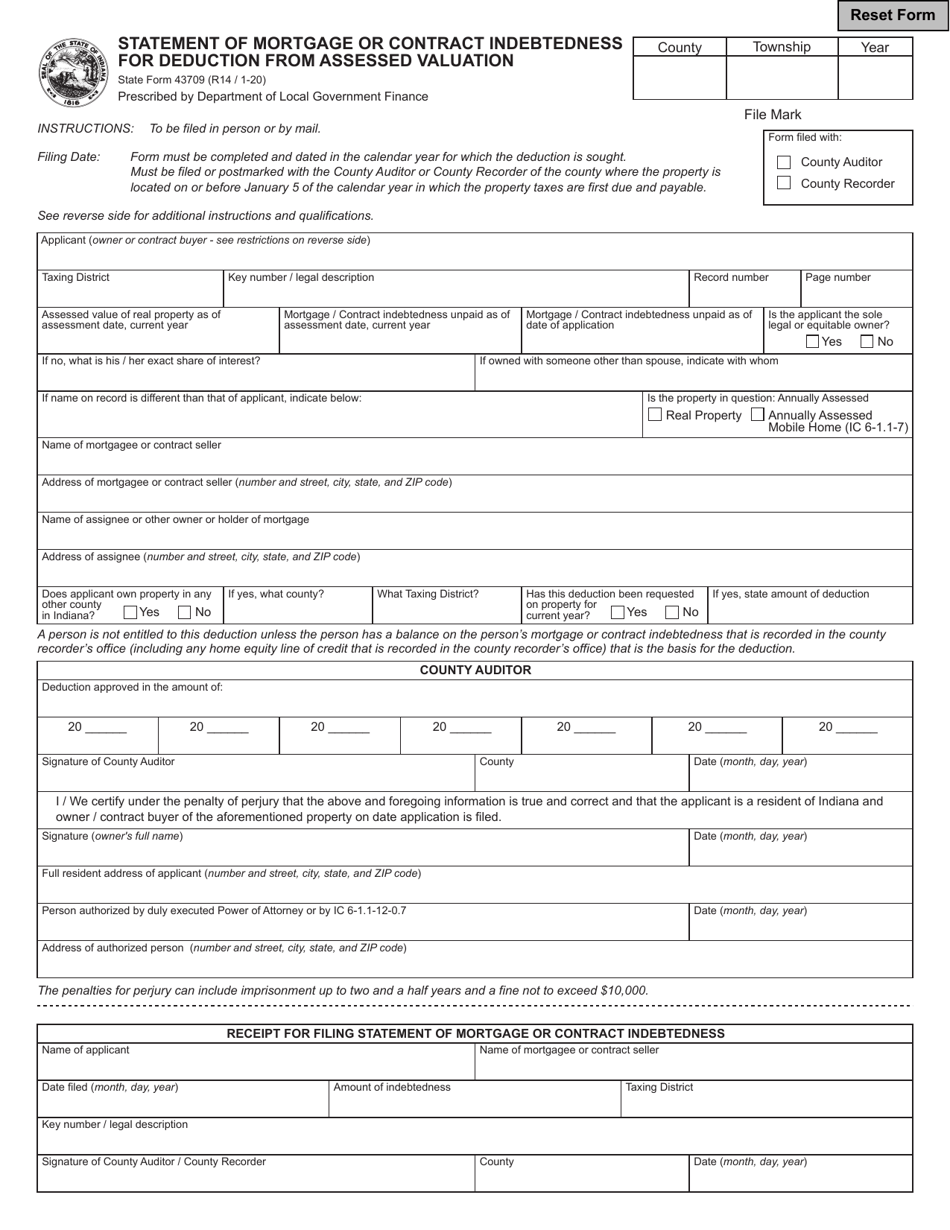

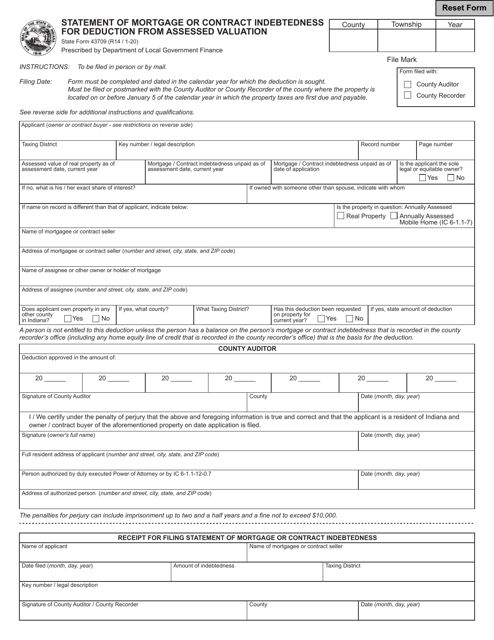

State Form 43709 Download Fillable Pdf Or Fill Online Statement Of Mortgage Or Contract Indebtedness For Deduction From Assessed Valuation Indiana Templateroller

Newsroom Archives Page 15 Of 17 Hj Sims

Save Money By Filing For Your Homestead And Mortgage Exemptions

1 Utep University Of Texas At El Paso

State Form 43709 Download Fillable Pdf Or Fill Online Statement Of Mortgage Or Contract Indebtedness For Deduction From Assessed Valuation Indiana Templateroller

Loving Restored Home Circa Old Houses

Grand Forks Gazette March 27 2013 By Black Press Media Group Issuu

Homes Near Wheeler Middle School School For Sale Homes Com

February 20 2013 Fort Bend Community Newspaper For Sugar Land Richmond Stafford Mo City Katy By Fort Bend Star Newspaper Issuu

Tbd 27 806 Acres Tbd 27 806 Acres Cr376 And Cr427 Anna Tx 75409 Anna Tx 75409 Compass

Dva Indiana Mortgage Company Inc

Tbd 27 806 Acres Tbd 27 806 Acres Cr376 And Cr427 Anna Tx 75409 Anna Tx 75409 Compass

Temple Tx Luxury Homes Mansions High End Real Estate For Sale Redfin

Indy Gov Apply For A Homestead Deduction